Čaplánová: základom reformy daní na Slovensku je prihliadanie na jej efektívnosť a redistribúciu daní

BRATISLAVA – Diskusia o reforme daňového systému nie je jednoduchá. Z teoretického hľadiska by mal byť daňový systém založený na maximalizácii stanovenej funkcie spoločenského blahobytu a reflektovať užitočnosti jednotlivých členov spoločnosti pri daných obmedzeniach. Uvažovanie s nelineárnosťou funkcie umožňuje zohľadniť špecifické spoločenské ciele. Samotný daňový systém ovplyvňuje motívy ľudí, mení ich správanie a má efektívnostné a redistribučné dopady. Vhodne navrhnutý daňový systém by mal teda nielen zabezpečiť očakávané daňové príjmy, ale aj minimalizovať mieru neefektívnosti a narušení alokácie zdrojov spôsobených zdanením.

Nájsť rovnováhu

V teoretickej rovine si zrejme väčšina z nás uvedomuje, že daňový systém by mal čo najviac prispievať k rastu prosperity krajiny a zohľadňovať užitočnosť každého občana. V praxi sa však často presadzujú návrhy zameriavajúce sa na riešenie priorít vybranej skupiny bez toho, aby sa zohľadnil ich vplyv na ostatné skupiny obyvateľstva. Pri napĺňaní politických programov strán sa spravidla hľadajú politicky prijateľné riešenia, ktoré prinesú dodatočné daňové príjmy potrebné napr. na pokrytie nákladov nových výdavkových opatrení, pričom efektívnostné a redistribučné dopady súvisiacich zmien v daňovom systéme zostávajú v úzadí.

Ak aj odhliadneme od politických cieľov, vybudovanie spravodlivého a efektívneho daňového systému je náročné aj v období takzvaných dobrých časov. V súčasnom období pretrvávajúca pandémia vyvoláva neistotu v ekonomickom prostredí, jej ekonomické dopady viedli k poklesu ekonomiky, rastu deficitu a zadlženia. Výrazne sú zasiahnuté najmä vybrané odvetvia ekonomiky. Je potrebné uskutočniť štrukturálne zmeny, reagovať na výzvy spojené s klimatickými zmenami, digitalizáciou a starnutím populácie. Všetky tieto faktory ovplyvňujú stav verejných financií a daňový systém. V tejto situácii by mal daňový systém vytvárať dostatočné prorastové impulzy, podporovať inovácie a akcelerovať prechod na uhlíkovo neutrálnu ekonomiku. Daňová reforma však tiež vyžaduje nájsť rovnováhu medzi efektívnosťou, rovnosťou, jednoduchosťou a v neposlednom rade umožniť výber očakávaných daňových príjmov. Pri jej príprave je potrebné zohľadniť aj efektívnostné a redistribučné dopady presunov medzi jednotlivými typmi daní.

Kto v skutočnosti platí podnikovú daň

Proponenti odklonu od zdanenia príjmu jednotlivcov spravidla zdôrazňujú, že nadmerné zdanenie príjmu nielen oslabuje stimuly ľudí k ekonomickej činnosti, ale aj zvyšuje ich motívy k vyhýbaniu sa plateniu daní, resp. k daňovým únikom. Progresívny systém zdanenia príjmu síce umožňuje napĺňať redistribučné ciele, je však spojený so znížením efektívnosti v ekonomike. Otázka rovnosti a vhodnej miery redistribúcie je naviac normatívnou otázkou, a žiadúca miera a štruktúra redistribúcie by mali byť predmetom spoločenskej voľby, ktorá sa v demokratických spoločnostiach spravidla uskutočňuje vo voľbách. Predstavy o preferovanej úrovni a formách redistribúcie by mali byť súčasťou politických programov strán uchádzajúcich sa o priazeň voličov.

Pri korporátnej dani je otvorená otázka daňovej incidencie, t.j. kto nesie konečné náklady dane a v akej miere. Väčšina ekonómov sa zhoduje, že dopady korporátnej dane sú rozdelené medzi prácu a kapitál, aj keď sa diskutuje o tom, v akom pomere. Z metodologických dôvodov neexistuje veľa empirických štúdií, ktoré by dávali na túto otázku jasnú odpoveď. Závery relatívne novej štúdie vychádzajúcej z analýzy panelových dát zohľadňujúcich približne 6800 zmien v daniach za obdobie 20 rokov v Nemecku (Fuest et al., 2017) publikované v jednom z najprestížnejších vedeckých ekonomických časopisov ukazujú, že zamestnanci nesú asi polovicu celkového daňového zaťaženia, pričom podiel pripadajúci na mladých zamestnancov, ženy a zamestnancov s nízkym vzdelaním bol ešte vyšší. To ukazuje, že výška korporátnej dane výrazne priamo ovplyvňuje aj zamestnancov firiem. V odbornej literatúre sa naviac zdôrazňuje aj negatívny vplyv vysokej korporátnej dane na ekonomický rast (napr. Arnold, 2008).

Predpokladá sa, že daň z kapitálových príjmov platia najmä bohatší ľudia vlastniaci kapitál. Vysoká miera zdanenia kapitálových príjmov sa preto zvykne považovať za vhodný spôsob zníženia príjmovej nerovnosti. Na zdanenie kapitálových príjmov však možno nazerať aj z iného hľadiska. Akumuláciu kapitálových aktív a výnosy z nich možno chápať ako odloženú spotrebu. Ak sú kapitálové príjmy zdanené, resp. ak je ich zdanenie vysoké, znižuje to motiváciu ľudí sporiť a akumulovať kapitálové aktíva, keďže budúca spotreba je zdanená viac, ako súčasná. Kapitál je naviac mobilný a ľahko ho možno presunúť do krajín s nižšou mierou zdanenia kapitálových výnosov. To sú zrejme kľúčové dôvody, prečo sa kapitálové aktíva zvyčajne zdaňujú relatívne nízkou sadzbou dane.

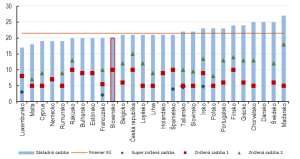

Výška sadzieb DPH v krajinách EÚ (2021)

Čo nevieme o DPH

Návrhy na presun daňového zaťaženia k zdaneniu spotreby sú často založené na argumente, že zdanenie spotreby stimuluje ekonomický rast. V krajinách EÚ je popri spotrebných daniach na vybrané tovary spotreba zaťažená daňou z pridanej hodnoty s jednou, alebo viacerými sadzbami dane. Z teoretického hľadiska má jedna sadzba dane výhodu napríklad v tom, že môže znížiť administratívnu záťaž spojenú s administráciou dane, ale aj snahu vyhýbať sa plateniu vyššej dane pri tovaroch, ktoré sa nachádzajú na hranici medzi základnou a zníženou sadzbou. V praxi však majú všetky krajiny EÚ s výnimkou Dánska dve, respektíve viac sadzieb DPH .

Rozdielne sadzby DPH majú zabezpečiť vyššiu dostupnosť základných spotrebných tovarov pre nízkopríjmové domácnosti, keďže ľudia s nízkymi príjmami vynakladajú na tieto statky veľkú časť svojho príjmu. Ľudia s vyšším príjmom síce míňajú na tovary základnej spotreby menšiu časť príjmu, v absolútnom vyjadrení však ide o väčšiu sumu. Majú teda zo zníženej sadzby dane väčší úžitok ako ľudia s nižším príjmom. Podľa nášho názoru je potrebné zvážiť, či neexistujú vhodnejšie nástroje na dosiahnutie sociálnych cieľov, ako znížená sadzba DPH.

Návrhy na presun zdanenia od priamych daní (zdanenia dôchodkov), k nepriamym daniam (zdaneniu spotreby) sa opierajú najmä o viaceré štúdie (napr. OECD) podľa ktorých môže takáto zmena podporiť ekonomický rast. Ani tento záver však nie je všeobecne prijímaný. Niektoré štúdie ukazujú, že v rôznych krajinách a v rôznych podmienkach môže zmena štruktúry daní mať na ekonomickú aktivitu rozdielny vplyv. Napríklad Bernardi (2013, 2019) na základe dezagregovanej analýzy vývoja zdanenia krajín Eurozóny za obdobie 2000-2014 poukázal na riziko, že presun od priameho k nepriamemu zdaneniu môže z krátkodobého hľadiska zosilniť ekonomický pokles v členských krajinách, najmä ak sa vo väčšine z nich uplatňuje reštriktívna fiškálna politika. Tento záver je aktuálny najmä v súčasnosti, keď tieto krajiny vychádzajú z recesie a v dôsledku rastu deficitov a dlhu počas pandémie stoja pred potrebou konsolidácie. Podľa záverov štúdie MMF zameranej na krajiny OECD (Acista-Omaechea & Morozumi, 2019) lepšie predpoklady podporiť dlhodobý ekonomický rast v porovnaní so zvýšením základnej sadzby dane vytvára rozšírenie základu DPH prostredníctvom menšieho rozsahu znížených sadzieb a existujúcich výnimiek.

Referencie:

- Acista-Omaechea, S., Morozumi, A. (2019) The Value Added Tax and Growth: Design Matters, IMF working paper No. 19/96, dostupné na internete: https://www.imf.org/en/Publications/WP/Issues/2019/05/07/The-Value-Added-Tax-and-Growth-Design-Matters-46836

- Arnold, J. (2008) Do tax structures affect aggregate economic growth?: Empirical evidence from a panel of OECD countries. OECD working paper, No. 643, dostupné na internete: https://doi.org/10.1787/236001777843

- Bernardi, L. (2013, 2019 aktualizované) Recent findings regarding the shift from direct to indirect taxation in the EA-17. MPRA Paper No. 47877, dostupné na internete: http://mpra.ub.uni-muenchen.de/47877/

- Fuest, C., Peichl, A., & Siegloch, S. (2018). Do higher corporate taxes reduce wages? Micro evidence from Germany. American Economic Review, 108(2), 393-418.

- Mankiw, N. G., Weinzierl, M., & Yagan, D. (2009). Optimal taxation in theory and practice. Journal of Economic Perspectives, 23(4), 147-74.

- Mooij, R.D., Keen, M. It is hard to design a fair and efficient revenue system, Finance and Development, pp. 68-69, dostupné na internete: https://www.imf.org/external/pubs/ft/fandd/basics/68-tax-in-practice.htm

Anetta Čaplánová, členka Rady pre rozpočtovú zodpovednosť. Originál komentára nájdete tu.